Medicare always paid 80% allowed amount and remaining 20% will be coinsurance.

To find the Medicare fee schedule go to your local Medicare website and get the fee schedule for particular insurance.

For Example

CPT 99213 – Allowed amount is $60.45 hence Medicare will pay the 80% that is $48.36. If patient has deductible then this amount will be processed towards patient Deductible.

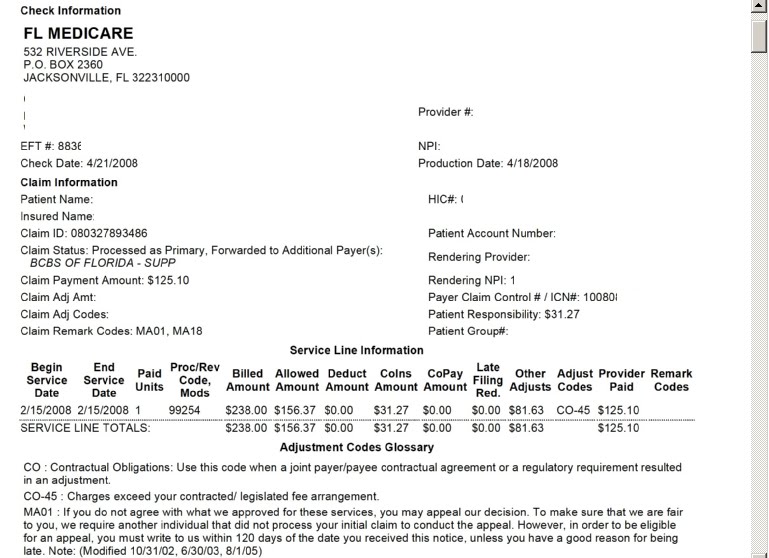

Here i have given the Medicare paid EOB for your reference.

I have listed some common terms in the Medicare payment EOB.

Per Prov: This field displays the beneficiary’s name, the billing provider number, the rendering provider number, the patient responsibility heading, and some message codes. When checking the reason for denial makes sure not to overlook this code. There may be remarks also in this field. These remark codes are

important to incomplete claim rejections. For example: REM: M76. This code needs to be defined in the glossary.

Serv Date: This field provides the service from and to dates as well as the patient’s responsibility.

POS: The place of service field contains a two digit number that references where the services were rendered.

NOS: The number of service field shows how many services were billed per procedure code.

Proc: The procedure code is located in this column as well as the patients Health Insurance Claim number (HIC) or the Medicare number.

MODS: If any modifiers were billed, they will be located in this field.

Claim Total Fields:

Billed: This field also contains the billed amount per procedure. If the patient account number is reported on the claim, Medicare will display that number in this field.

Allowed: This column displays the allowed amounts per procedure. This amount is based on the Medicare Fee Schedule.

Deduct: If any deductible is applied the amount will show in this field. The Internal Control Number (ICN) will also appear in this column.

Coins: This is the coinsurance field. The amount of the beneficiary’s coinsurance, 20% of the allowed amount, will be displayed here.

Group Reason Code (GRP/RC): Group codes represent the financially responsible party. Reason codes explain denials and payments. These combination of codes are defined in the glossary at the bottom of the Standard Provider Remittance. An on line reference is available for your convenience is available for your convenience, as well as a full listing in chapter 21.

Grp/RC-Amt: This column contains the type of assignment (ASG). A “Y” indicator shows the provider accepted assignment. A “N” indicator shows a non-assigned claim. Under the assignment indicator are the non-covered service amounts. These amounts will equal the difference between the billed amount and allowed amount. The last field in this column is a total of the non-covered amounts.

Prov. Pd: The amount paid per procedure is displayed in this field. Also the total amount paid on this claim is shown in this column. The claim total reported is the net payment. The MOA (Medicare outpatient adjudication remarks) code is the heading. This code does not display any adjustments or reasons. The codes following this heading explain the outcome of the claim, and also need to be defined in the glossary. There is also a full listing in chapter 21.

Adj. To Totals: Adjustments are printed on the ADJs line.

Prev Pd: For full claim adjustments, the Prev Pd field represents the previous accumulative payment to the provider, on an original claim, and has the GRP/RC-AMT value OA-B13

INT: This field represents the difference between the current interest on the adjustment claim and the previous interest from the original claim.

Late Filing Charge: This field represents the reduction taken when the claim was submitted more than 1 year after the date of service.

Claim Information Forwarded To: This represents the patient’s secondary insurance carrier.

Net: This field represents the net amount for a given claim, which should be the actual amount being paid for that claim to the provider. This field does include interest.

Summary (Totals) fields:

# Of Claims: Number of claims displayed on the SPR.

Billed Amt: Total amount billed on the SPR.

Allowed Amt: Total allowed amount on the SPR. This amount is based on Medicare’s Fee Schedule.

Deduct Amt: The total amount of the deductible applied on the SPR.

Coins Amt: Total amount of coinsurance on the SPR.

Total RC-Amt: Total amount of non-covered services. This is the difference between the total billed amount and the total allowed amount.

Prov. Pd Amt: The total amount paid on the SPR. This should be the check amount if no adjustments were made.

ADJS Fields:

Prov Adj. Amt: The amount the check has been adjusted from the provider’s aid amount.

Check Amt: The amount of the check.